Why TINCheck?

Fast

Expedite new customer & vendor onboarding with accurate identity verification in seconds.

Flexible

Use real-time checks, bulk upload, or our API to fit seamlessly into your existing workflow.

Complete

Screen against the IRS database and 20+ global watchlists in one click.

Affordable

Plans start at just $19.95/month. With monthly plans and volume discounts for growing teams .

Interested? See our demo

Stay Ahead of Compliance Risks with Fast, Accurate

TIN Matching

Onboard vendors, gig workers, and customers faster and instantly verify existing data to stay compliant, reduce risk, and avoid penalties using TIN Matching. Properly implementing these measures enhances customer onboarding, making the process more efficient and secure.

Onboard vendors and gig workers instantly

Verify new customers and reduce fraud

Verify new customers and reduce fraud

Automate KYC, AML processes with the government’s watchlists.

Integrate real-time TIN matching via API for a compliant onboarding process.

Avoid IRS B-Notices and penalties.

How Much is Your Business Risking in Penalties?

Did you know?

20% of TIN Checks – or 1 in every 5 – do not match IRS Records.

Data based on TINCheck customer inputs across millions of checks in 2024

That could mean thousands of dollars in avoidable penalties.

Verify Against 20+ Global Databases

Verify individuals and businesses in real time against our comprehensive verification list – including the IRS, Death Master File (DMF), OFAC, and 20+ global databases.

US taxpayer verification – IRS TIN and Name matching, EIN Name Lookup, IRS Exempt Organizations, Global Intermediary Identification Number (GIIN), Death Master File, USPS Address Validation

Office of Foreign Assets Control (OFAC) – Consolidated Sanctions, Specially Designated Nationals (SDN), Sectoral Sanctions Identifications, Foreign Sanction Evaders, Denied Persons, Palestinian Legislative Council (PLC), Iranian Sanctions Act, Foreign Financial Institutions

US and state watch lists – Casino Banned Patrons, Entity List, Unverified List, FBI Wanted, Excluded Individuals and Entities, Excluded Parties, Arms Export Control Act (AECA), Designated Foreign Terrorist, Politically Exposed People,

Global sanctions – Canadian Consolidated Regulations, EU Sanctions, Interpol Wanted, Anti-Terrorism Financing & Entities, Iran-Syria Nonproliferation Act, United Nations Consolidated, Ukraine-Russia Related Sanctions, US Commodity Administrative & Reparations Sanctions.

Enterprise-Grade Security You Can Trust

TINCheck is built with your data security in mind. We use TLS/SSL encryption and process all data in SSAE SOC 2 and ISO 27001 certified data centers. You can enable two-factor authentication (2FA) for added protection, and manage user access and validation settings directly from your dashboard.

For more information on how we protect your data, visit our Security Page

TINCheck Services

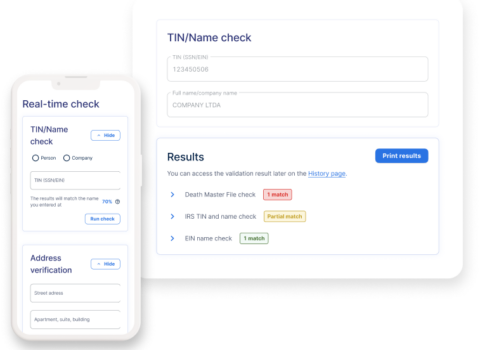

Real-Time TIN

Check name and TIN combinations against IRS records and 20+ global databases — instantly and with confidence.

TINCheck API

Embed real-time TIN validation into your onboarding or vendor management process — no extra clicks, just clean data from day one.

Bulk Match

Upload large datasets to catch mismatches before filing 1099s or cleaning your vendor list. Get full results within 24 hours.

Join thousands of businesses using TINCheck to easily verify customer and vendor data.

Sign up now and try your first real-time check for free. Then pick the plan that is right for your organization.